Imagine paying $150 a month for your arthritis medication-then finding out you could pay just $45 by asking for a simple change. That’s not a dream. It’s a tier exception, and millions of people are leaving money on the table because they don’t know how to use it.

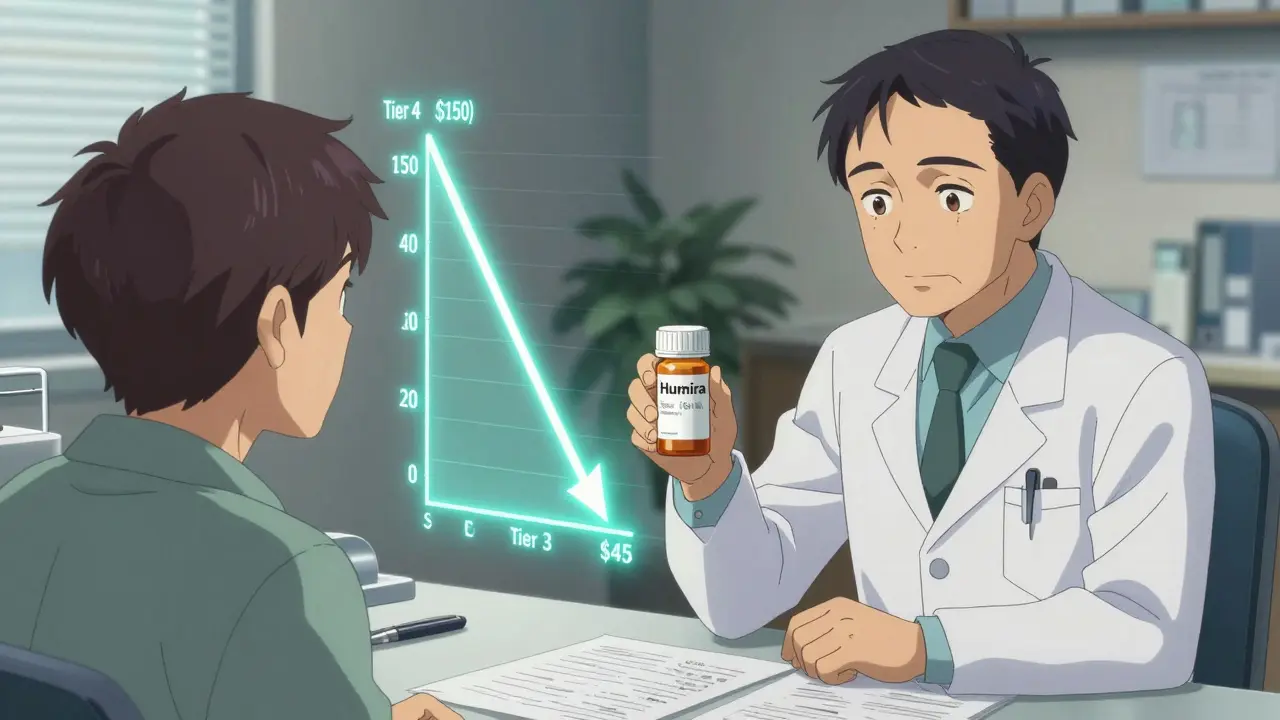

If you’re on Medicare Part D or another prescription drug plan, your medications are grouped into tiers. Tier 1 usually means low-cost generics. Tier 3 or 4? That’s where brand-name drugs sit-and that’s where your wallet gets hit hard. A tier exception lets you move a drug from a high-cost tier to a lower one, if your doctor proves it’s medically necessary. It doesn’t change the drug. It changes the price.

How Drug Tiers Work (And Why They Cost You)

Most Medicare Part D plans use a 4- or 5-tier system to control costs. Here’s what that looks like in practice:

- Tier 1: Generic drugs. Copay: $0-$10

- Tier 2: Preferred brand-name drugs. Copay: $10-$20

- Tier 3: Non-preferred brand-name drugs. Copay: $30-$100

- Tier 4: Preferred specialty drugs. Coinsurance: 20-30% of drug cost

- Tier 5: Non-preferred specialty drugs. Coinsurance: 30-40%-sometimes over $1,000 a month

These tiers aren’t about which drug works better. They’re about which drug the insurance company negotiated a better price on. A drug in Tier 3 might be just as effective as the one in Tier 2-it’s just more expensive for the plan to buy. So they push you toward the cheaper one.

But what if the cheaper one doesn’t work for you? Maybe it gives you nausea. Maybe it doesn’t control your symptoms. Maybe you had a bad reaction last time. That’s where a tier exception comes in.

What Is a Tier Exception? (And What It’s Not)

A tier exception is a formal request to your insurance plan to treat a drug as if it’s on a lower tier-so you pay less. It’s not the same as a formulary exception. A formulary exception is when you ask to get a drug that’s not on the plan’s list at all. A tier exception is when the drug is already covered, but you’re stuck paying too much.

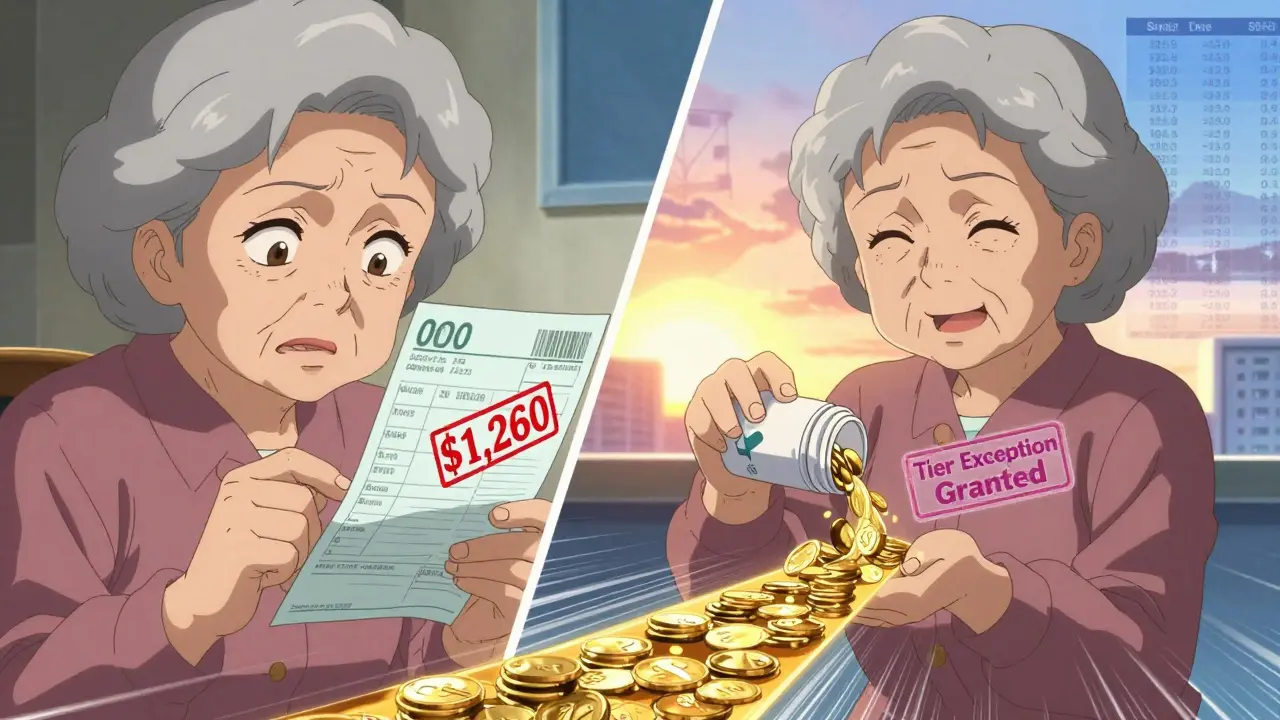

For example: Your doctor prescribes Humira. Your plan lists it in Tier 4, so your copay is $150. But your doctor knows you’ve tried two other biologics and both failed. You need Humira. A tier exception lets you ask: Can we treat Humira like it’s in Tier 3? If approved, your copay drops to $45. That’s $1,260 saved per year.

According to the Centers for Medicare & Medicaid Services (CMS), tier exceptions are one of the most underused tools in Medicare Part D. Only about 18% of patients who could qualify actually request one. That’s a lot of money going to waste.

When a Tier Exception Makes Sense

You should consider a tier exception if:

- Your medication is on your plan’s formulary, but in a high tier (Tier 3 or higher)

- You’ve tried lower-tier alternatives and they didn’t work

- You had side effects from a preferred drug

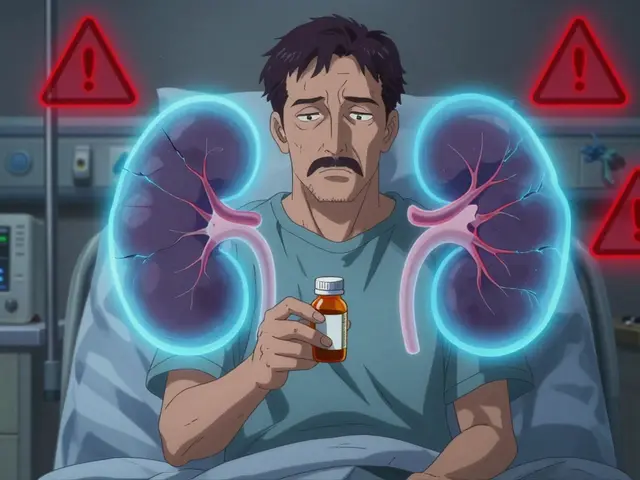

- You’re on a specialty drug like those for MS, rheumatoid arthritis, or cancer

- Your monthly copay is over $50 and you’re on a fixed income

People with chronic conditions benefit the most. A 2023 Medicare Rights Center survey found that 58% of those who requested a tier exception for medications used to treat autoimmune diseases, heart conditions, or neurological disorders got them approved. The average savings? $37.50 per fill. That adds up to over $450 a year for a single prescription.

And here’s the kicker: if your drug moves from Tier 4 to Tier 2, you might also avoid the coverage gap (donut hole) entirely. That’s because lower-tier drugs count differently toward your out-of-pocket maximum. A single approval can save you hundreds in the long run.

How to Request a Tier Exception (Step by Step)

It’s not complicated-but it does require the right paperwork. Here’s how to do it right:

- Check your plan’s formulary. Log into your insurer’s website or call customer service. Find your medication and see which tier it’s on. Write it down.

- Ask your doctor. Don’t wait until you get the bill. Bring it up the next time you see them. Say: “This drug is in Tier 4 and costs $150 a month. Is there a way we can get it moved to a lower tier?”

- Get the right documentation. Your doctor needs to complete a tier exception form. This isn’t a quick note. They need to explain why you can’t use a lower-tier drug. Good reasons include:

- “Patient experienced severe gastrointestinal bleeding on Warfarin, requiring hospitalization.”

- “Patient developed rash and swelling with preferred alternative, indicating hypersensitivity.”

- “Patient has tried two Tier 2 medications with no improvement in HbA1c levels.”

Avoid vague statements like “The patient prefers this one” or “They don’t like the side effects.” Insurance companies need clinical evidence, not preference.

- Submit the request. Your doctor’s office can submit it directly. Or you can submit it yourself through your insurer’s online portal. Keep a copy of everything.

- Wait for a decision. If your doctor says your health could be at risk without the drug, request an expedited review. That means a decision in 72 hours. Otherwise, you’ll wait up to 14 days.

- If denied, appeal. Don’t give up. About 37% of initial requests are denied-but 78% of those get approved on appeal. The key? Add more clinical detail. Your doctor might need to write a second letter with lab results, prior treatment records, or specialist notes.

What Gets Approved-and What Doesn’t

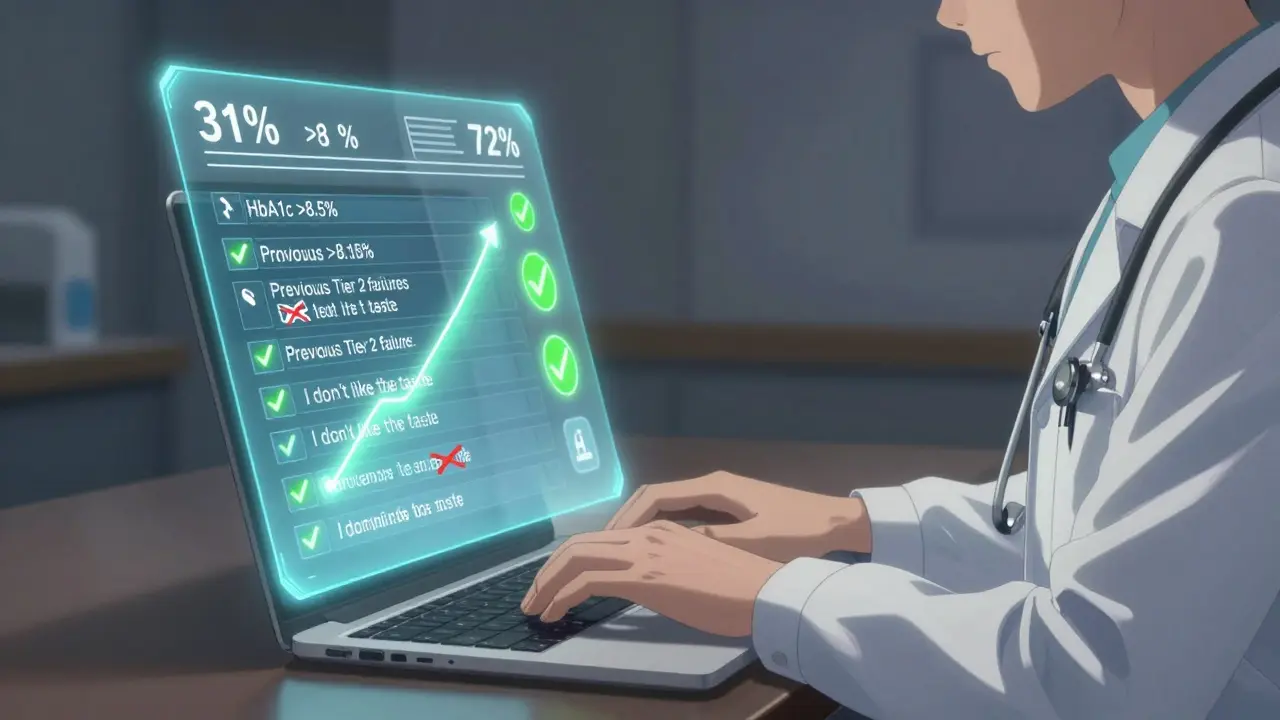

Approval rates vary by plan, but data from CMS shows that when a doctor submits a clear, detailed letter, approval jumps to 72%. When the letter is vague? Approval drops to 31%.

Here’s what works:

- Specific side effects: “Patient developed pancreatitis on Metformin.”

- Lab results: “HbA1c remained above 8.5% despite 6 months on Tier 2 medication.”

- Previous failures: “Two prior Tier 1 and Tier 2 drugs failed to control symptoms.”

- Specialty drug necessity: “Patient has relapsing-remitting MS and requires monthly infusion.”

Here’s what fails:

- “I don’t like the taste.”

- “It’s cheaper on GoodRx.”

- “I’ve been on it for 5 years.”

- “My neighbor takes it and pays less.”

Insurance companies aren’t being cruel-they’re following rules. But those rules allow flexibility when medical need is proven.

Real Stories: What Happens When People Ask

One user on Reddit shared: “My doctor submitted a tier exception for my Humira. Went from $150/month to $45. Took 10 days. No drama.”

Another tried twice for Xarelto. First time denied because the doctor wrote: “Patient has atrial fibrillation.” Too vague. Second time, the doctor added: “Patient has history of GI bleeding, contraindicating aspirin and clopidogrel. Xarelto is the only anticoagulant tolerated.” Approved to Tier 2. Copay dropped from $60 to $40. Not perfect-but still $20 saved per month.

A 72-year-old woman with rheumatoid arthritis saved $520 a year after her doctor moved her Enbrel from Tier 4 to Tier 3. She said: “I was choosing between my medication and my heating bill. Now I can do both.”

Timing Matters: Request Early, Not Late

Don’t wait until you’ve filled your prescription three times. The best time to request a tier exception is before you pick up your first dose. That way, you avoid paying full price upfront.

Some doctors are now doing “proactive tier exceptions”-submitting the request at the same time as the prescription. One study found this approach led to 89% same-day approval. That’s faster than most online orders.

And if you’re switching plans during Open Enrollment, check the formulary early. A drug that’s in Tier 2 this year might be in Tier 4 next year. If you’re on a high-cost medication, request a tier exception before your new plan starts.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act caps out-of-pocket drug costs at $2,000 per year for Medicare Part D beneficiaries starting in 2025. That’s huge. But here’s the catch: that cap only kicks in after you’ve spent $2,000. If you’re paying $150 a month for a drug, you’ll hit that cap in under a year. But if you get that drug moved to Tier 3 and pay $45 instead? You’ll never hit the cap.

And even with the cap, tier exceptions still matter. They reduce your monthly spending. They keep you out of the coverage gap. They make it easier to afford other medications. They give you more control.

Plus, insurance companies are making it easier. UnitedHealthcare launched an automated tool in 2023 that lets doctors check approval odds before submitting. Other plans are rolling out digital forms and faster responses. The system is improving-but you still have to ask.

What to Do Next

Here’s your action plan:

- Look up your top 1-2 most expensive prescriptions.

- Find their tier on your plan’s formulary.

- If it’s Tier 3 or higher, schedule a quick call with your doctor.

- Ask: “Can we file a tier exception to lower my copay?”

- If they say yes, make sure they document why the lower-tier drugs won’t work.

- Follow up in 10 days. If you’re denied, ask for the denial reason and file an appeal.

You don’t need to be a medical expert. You don’t need to argue. You just need to ask-and make sure your doctor gives the right reasons.

Every year, tens of thousands of people save hundreds-or even thousands-of dollars using tier exceptions. You’re not asking for a favor. You’re using a right built into your plan. And if you don’t ask, you’ll never know what you could’ve saved.

What’s the difference between a tier exception and a formulary exception?

A tier exception asks your insurance to treat a drug that’s already on the formulary as if it’s in a lower cost tier-so you pay less. A formulary exception asks to cover a drug that’s not on the formulary at all. Tier exceptions are more common and easier to get approved because the drug is already approved for use; you’re just asking for better pricing.

Can I request a tier exception myself, or does my doctor have to do it?

You can start the request, but your doctor must provide the medical justification. Insurance plans require a signed statement from your prescriber explaining why lower-tier drugs won’t work for you. Without that, your request will be denied. Your doctor’s office usually handles the paperwork, but you can submit it yourself through your insurer’s online portal if needed.

How long does a tier exception take to approve?

Standard requests take up to 14 days. If your doctor says your health could be at risk without the drug-for example, if you’re at risk of hospitalization-you can request an expedited review. That means a decision within 72 hours. Always ask for expedited if you’re running low on medication or facing high out-of-pocket costs.

What if my tier exception is denied?

Don’t give up. About 37% of initial requests are denied-but 78% of those are approved on appeal. The most common reason for denial is insufficient medical documentation. Ask your doctor to write a more detailed letter with specific clinical reasons: side effects, lab results, past treatment failures. You have the right to appeal, and many people succeed on the second try.

Will a tier exception affect my coverage gap (donut hole)?

Yes. Lower-tier drugs count differently toward your out-of-pocket spending. If you move from Tier 4 (coinsurance) to Tier 2 (fixed copay), you’ll pay less per fill, and those payments will count more toward getting you out of the coverage gap. In some cases, you might avoid the gap entirely.

Are tier exceptions only for Medicare Part D?

No. Many private insurance plans, Medicaid managed care plans, and employer-sponsored drug plans also use tiered formularies and offer tier exceptions. The process is similar: ask your doctor to prove medical necessity. Check your plan’s member handbook or call customer service to find out if they offer this option.

This is why America is broken. You need a PhD just to afford a pill. 🤦♀️ I pay $45 for Humira too. My doctor did the paperwork. No drama. Why don't more people know this? Because corporations want you suffering.