Every year, 125,000 Americans die because they can’t afford to take their medicine as prescribed. That’s not a statistic from a dystopian novel-it’s from the American Heart Association. And it’s happening right now, in neighborhoods across the country, to people with insurance, to seniors on Medicare, to working parents juggling rent and groceries. The problem isn’t laziness or forgetfulness. It’s cost.

Why Cost Stops People from Taking Their Medication

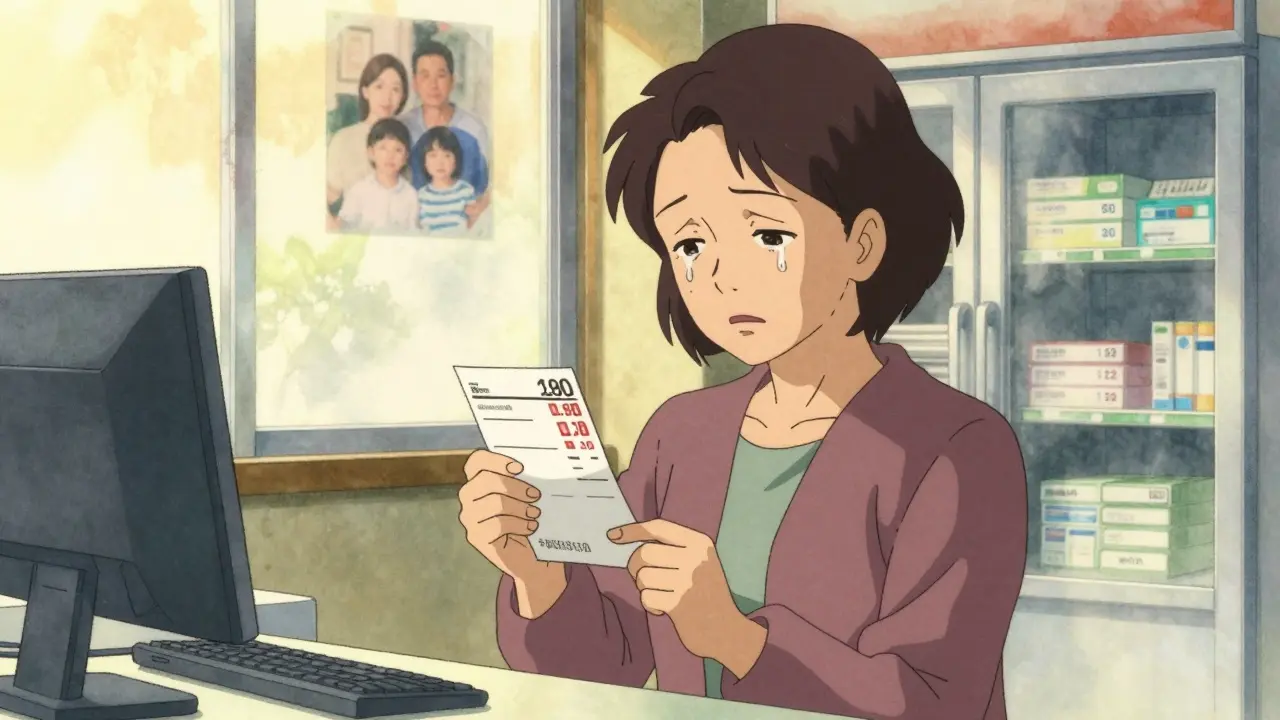

You might think if you have insurance, you’re covered. But that’s not how it works. High copays, deductibles, and coinsurance mean many patients still pay hundreds a month just to stay alive. A 2023 study in the American Journal of Managed Care found that when a monthly copay jumped from $10 to over $50, adherence dropped by 15-20%. For someone on insulin, that could mean paying $800 a month-even with insurance. It’s not just the price tag at the pharmacy. It’s the surprise. Forty-one percent of patients say they walked into the pharmacy expecting one price and got hit with another. That’s called “sticker shock,” and it leads people to leave without their meds. Some skip doses. Some split pills. Others delay refills until they’re sick enough to go to the ER-costing the system way more than the drug ever did. The burden hits hardest for people with chronic conditions: heart disease, diabetes, high blood pressure. These aren’t one-time fixes. These are lifelong meds. And for low-income families, choosing between medicine and food isn’t a hypothetical-it’s daily reality. The CDC reports that 8.2% of working-age adults skipped meds last year because of cost. Among those making under $25,000 a year, the rate is over three times higher than for those earning over $75,000.How Medication Costs Are Structured to Hurt You

Pharmaceutical companies set list prices. Insurers negotiate discounts. But you don’t see those discounts. You see the copay. And often, the copay doesn’t reflect the real cost of the drug. Tiered formularies push patients toward more expensive brand-name drugs-even when generics exist. A $500 insulin pen might be on Tier 3, while a $30 generic alternative sits on Tier 1. But your doctor didn’t know that when they wrote the script. Medicare Part D was supposed to help seniors. But before 2025, beneficiaries still faced a “donut hole”-a gap in coverage where they paid 100% out of pocket. Even now, with the Inflation Reduction Act capping out-of-pocket costs at $2,000 annually, many seniors still pay $350 a month after their Part D kicks in. One 62-year-old woman told Kaiser Health News she chooses between her blood pressure pills and her groceries every month. And it’s not just seniors. Younger people with employer insurance are getting hit too. A 2022 survey found that 18% of all U.S. adults didn’t fill a prescription because of cost. That’s one in five. And for drugs like semaglutide (Ozempic, Wegovy), which cost over $1,000 a month, even insured patients are forced to choose: take the drug or pay rent.What You Can Do Right Now to Lower Your Costs

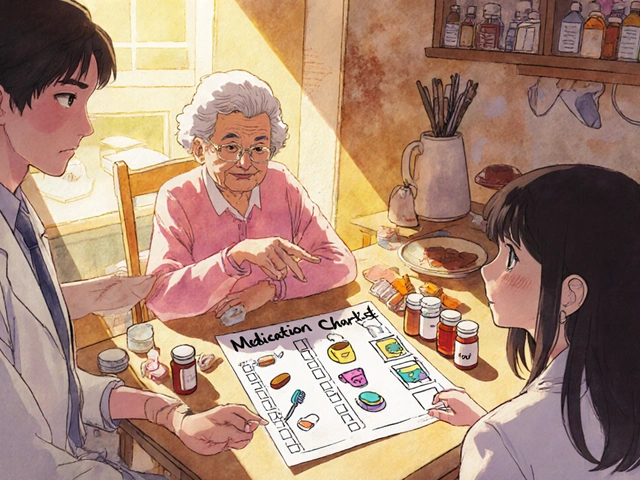

You don’t have to suffer in silence. There are real, proven ways to cut your medication costs-right now, without waiting for policy changes. Ask your doctor about alternatives. Not all drugs are created equal. A generic version might cost $10 instead of $400. Ask: “Is there a cheaper drug that works just as well?” Your doctor may not know the price unless you ask. The American Medical Association says checking your insurance’s formulary before prescribing is one of the simplest ways to help patients. Use GoodRx or SingleCare. These free apps show you the lowest cash price at pharmacies near you-even if you have insurance. In many cases, the cash price is lower than your copay. For insulin, diabetes meds, or blood pressure pills, savings of 50-80% are common. Over 35 million Americans use these tools every month. Ask for a 90-day supply. Many insurers charge the same copay for a 30-day or 90-day supply. That means you pay once, get three months of meds, and save on trips to the pharmacy. Mail-order pharmacies often offer even bigger discounts. Express Scripts reports 20-30% savings on 90-day fills. Apply for patient assistance programs. Nearly every major drugmaker has a program for low-income patients. Eligibility is often based on income under 400% of the federal poverty level ($55,520 for one person in 2023). These programs can slash a $500 insulin bill to $25 a month. The Partnership for Prescription Assistance helps connect people to these programs-and helped over 1.2 million people in 2022. Check if you qualify for Medicare Extra Help. If you’re on Medicare and your income is low, this program can cover up to $5,000 a year in drug costs. You don’t need to be broke-just below the income threshold. Apply through Social Security.

Real Stories: From Breaking Point to Relief

One woman in Ohio had type 2 diabetes. Her insulin cost $500 a month. She was taking half the dose to make it last. Her blood sugar spiked. She ended up in the hospital. After her social worker helped her enroll in the manufacturer’s patient assistance program, her cost dropped to $25. Her adherence jumped from 60% to 95%. Her A1C fell from 10.2 to 6.8. A veteran in Texas was paying $320 a month for his heart medication. He was skipping days. He found a GoodRx coupon that cut it to $45. He started taking it daily. His blood pressure stabilized. He didn’t go back to the ER. These aren’t rare cases. They’re common. And they happen because someone asked for help.What’s Changing in 2025 (And Why It Matters)

The Inflation Reduction Act is finally making real changes. Starting in 2025, Medicare beneficiaries will pay no more than $2,000 a year out of pocket for prescriptions. The “donut hole” is gone. And for the first time, high-cost drugs can be paid for in monthly installments through the new Medicare M3P plan. More insurers are also rolling out real-time benefit tools (RTBTs). These systems show your doctor the exact price of a drug before they write the prescription. That means fewer surprises at the pharmacy. But here’s the catch: 37% of these price estimates are still off by more than $10. So don’t rely on them alone. The FDA approved over 1,100 generic drugs in 2022. That’s more competition. More savings. But generics don’t help if your doctor doesn’t prescribe them.

What You Should Never Do

Don’t stop taking your meds because you can’t afford them. Don’t split pills unless your doctor says it’s safe. Don’t assume your insurance covers everything. And don’t feel ashamed to ask for help. Cost-related nonadherence isn’t your fault. It’s a broken system. But you’re not powerless.Where to Start Today

1. Write down every medication you take, including dose and frequency. 2. Check the cash price on GoodRx or SingleCare for each one. 3. Call your pharmacy and ask: “What’s the lowest price I can pay today?” 4. Talk to your doctor: “I’m struggling to afford this. Are there cheaper options?” 5. Go to pparx.org and enter your meds to find patient assistance programs. 6. If you’re on Medicare, apply for Extra Help at ssa.gov. You don’t need a degree in healthcare policy to save your life. You just need to ask.Why do I still pay so much for my meds even though I have insurance?

Insurance doesn’t mean free. You still pay copays, coinsurance, and meet deductibles. Many drugs are placed on high tiers, forcing you to pay more. Sometimes, the cash price at the pharmacy is lower than your insurance copay. Always check GoodRx or ask your pharmacist for the best price.

Can I get help if I make too much for Medicaid but still can’t afford my meds?

Yes. Many pharmaceutical companies offer patient assistance programs for people earning up to 400% of the federal poverty level-$55,520 for one person in 2023. You don’t need to be poor to qualify. Programs like those from insulin makers, heart disease drug companies, and diabetes providers can cut your bill by 90% or more.

Is it safe to split pills to make them last longer?

Only if your doctor or pharmacist says it’s safe. Some pills are designed to release medication slowly and shouldn’t be split. Others, like certain blood pressure or cholesterol pills, can be safely halved. Never split pills without professional advice-it can change how the drug works or cause dangerous side effects.

How do I know if a patient assistance program is legitimate?

Stick to programs run by the drug manufacturer or verified nonprofits like the Partnership for Prescription Assistance (pparx.org). Avoid websites asking for credit card info upfront or charging enrollment fees. Legit programs are free to apply for and won’t ask for payment before you get your meds.

Can I use GoodRx if I’m on Medicare?

Yes. GoodRx can often beat Medicare Part D prices, especially before you hit your deductible. You can choose to use GoodRx instead of your insurance. Just tell the pharmacist you’re paying cash. Some seniors save hundreds a month by doing this.

What if my doctor won’t switch my medication because they say it’s the best one?

You have the right to ask for alternatives. Say: “I love this medication, but I can’t afford it. Is there another one that works just as well and costs less?” Many doctors don’t know the prices. Some may not realize a generic or older drug works just as well. Don’t be afraid to push back. Your health matters more than brand names.

If you’re struggling to pay for your meds, you’re not alone. And help exists. Start with one step today-check your prescription price on GoodRx, call your doctor, or visit pparx.org. Your life depends on it, and you deserve to take your medicine without choosing between it and your next meal.

i just filled my insulin script and paid $42. i thought i was gonna cry. my insurance said $120. goodrx saved me. i dont even know how i lived without it.